Out of What One Has

by admin | Jan 30, 2024 | Bible Study, Budget |

“I speak not by commandment, but I am testing the sincerity of your love through the diligence of others. For you know the grace of our Lord Jesus Christ, that though He was rich, yet for your sakes He became poor, that you through His poverty might become rich. And in this I give advice: It is profitable for you not only to be doing what you began and were intending to do a year ago; but now you also must complete the doing of it; that as there was an eagerness to purpose it, so there also may be a completion out of what you have. For if something is presented eagerly, it is accepted according to what one has, and not according to what he does not have. For I do not mean that others should be eased and you burdened; but by an equality, that now at this time your abundance may supply their lack, that their abundance also may supply your lack; that there may be equality. As it is written, He who gathered much had nothing left over, and he who gathered little had no lack.” 2nd Corinthians 8:8-8:15

I should think that of most of the financial troubles that people get themselves into, that this little concept found in this passage of the Bible, if followed, would probably prevent the vast majority of troubles caused by spending too much.

The principle found here is ‘according to what one has, and not according to what he does not have.’ While the context is not exactly the same and a simple study of the above passage would show that, still this ties in with being content, abounding and abasing, something that will be talked about in the next segment.

Recently I was pondering the radio program that is aired here and there across the United States and in Africa. Thus far, the Lord has provided the funds necessary to keep the show on the air. Without getting into the details, when I signed a contract, I was assured that if this small ministry ‘did not have’ the money to continue paying for the show, there was a fairly easy out, a contractual term that is generally not allowed.

For years, though not with perfection, as I indeed did run into a problem for around 3 or so years, I followed this biblical principle:

“Owe no one anything except to love one another, for he who loves another has fulfilled the Law.” Romans 13:8

When I moved out to Kalispell, Montana from Michigan, I ended up with a job as an assistant manager, eventually becoming the general manager at a McDonalds. There was a class that had to be taken and there was an agreement that had to be signed that you would work for the company for ‘x’ amount of months or you would have to pay the owner back for the class, which was around $500 or so dollars at the time.

I was moving up in the company fast and they needed me to take this course, but I went to my district manager and refused to sign the paperwork. I would take the class, but I would not agree that I would work for them for the next 6 months or so, with an amount due, should I quit prior.

I had my reasons, but I also had a principle and that principle was to owe no man anything. My family and I had zero debt, not a penny owed to a single person for anything. We rented a home, we had a paid off truck, we owned outright all of our possessions and if we followed that principle, which we had for years, then why would it be broken at this time?

Long story short, eventually the owner and the district manager met with me. They did not know what to do, as they couldn’t make an exception for only one manager (there were several attending this class) then suddenly the owner came up with a plan.

I would give him the money and he would slowly pay me back…bingo…there it was, problem solved. So having all of the money on hand should I quit, why was I concerned?

Well we had just moved to that part of the country under the not-so-best circumstances and we were not sure how long we would stay there or could stay there (certainly some immaturity as a Believer there). So the principle was so strongly engrained, as we already had a place prepared for us numerous miles away, should the need arise, the question was if we had to flee, how would this person get paid?

In hindsight, probably there would have been a readily available solution and the meeting was unnecessary. Still it goes to show how engrained such a biblical principle was in our minds. In fact when we broke that principle due to adding an ‘*’ a couple years later, we certainly suffered for a few years, clearly remembering why we had held those biblical principles and getting back on track as quickly as possible.

Of course, if one were to consider owing no man nothing, would there not rise questions about purchasing a home, perhaps a car, paying for college, starting a business, etc. So are there exceptions or where should the Christian make an exception…well certainly following the Bible.

Where most people actually run into problems, likely the same people who would point out the above things but then use their perceived liberty to do things that are outside of those categories, is not from purchasing a home (perhaps recently with the prices), but oftentimes this is from acquiring debt due to things that really could have been done without or maintaining a lifestyle that simply wasn’t prudent to the means that God had provided to them or that family.

In many places across the country, renting a home can cost $1,800/month + all utilities. Without even assuming the raising rental cost over the next 30 years or looking at the current high interest rates when considering the ballooned housing prices, but just some very basic math…to rent that house at that cost for 30 years would be the following:

$1800.00 x 30 Years x 12 Months (per year) = $648,000.00

My current situation would be as follows, knowing that they already wish to get an extra $100 per month from where we currently rent:

$1400.00 x 30 x 12 = $504,000.00

This house would probably be valued at about $245,000.00. If you were to add the interest on a loan, the annual taxes (around $4,000/year), as well as repair and maintenance, then that price would be astronomical as is.

Recently I called and spoke to a mortgage officer that I know. If I were to get approved, use the South Dakota down payment assistance, my approval from the bank would likely allow me a payment (with taxes, home owner’s insurance and PMI) around $3,100 – $3,250 per month.

That would be around a house that would cost up to $325k in Rapid City, SD, which would likely still be a house that would need some work or the desire for some work. (A couple of years ago you could purchase the same type of home at a very low interest rate + $199k brand new (3 bedroom/2 bath townhome) in Rapid City, where the payment with escrow would have actually been around $1400, what is what we pay now for rent.)

When I spoke to the woman on the phone, she did pause when she told me what the payment would be. She knew my income and I told here that I had ‘x’ amount of credit card credit available, but I would never use that, I would be bankrupt. Quite honestly it would be –impossible- for us to afford that amount on our own, with our current income. What would we eat?

However, we could easily be paying more for rent, whether we could ‘afford’ it or not, housing could be cheaper to purchase than what it is, so those very rudimentary numbers could easily switch to a much clearer advantage of purchasing a home. Then we could factor in after the 30 years, however long one lives, there is simply the repairs/maintenance/insurance/taxes on that home, therefore the saving are even more apparent.

The goal has never been to write a book or a series of articles on financial common sense or speaking of how to get out of debt or how to save for retirement, etc. I would make a poor example in the world’s eyes for most of these things, some of which was due to NOT following principles in the Bible that did relate to finances when I was younger.

There are books written as such, but from the ones that I have seen, they often lack on using the Bible as their guide and more on the ‘wisdom of the world’.

“Let no one deceive himself. If anyone among you seems to be wise in this age, let him become foolish that he may become wise. For the wisdom of this world is foolishness with God. For it is written, He catches the wise in their own craftiness; and again, The Lord knows the thoughts of the wise, that they are vain.” 1st Corinthians 3:18-20

As far as purchasing a home? Not as long ago as people think, people would build their own homes, often on a piece of land that they would purchase or sometimes acquire through the right of way of some sort of governmental edict. Either way you are going to make a payment, whether to a landlord or to a bank.

Vehicles perhaps are a more ‘iffy’, but there are occasions where someone might get a job that requires travel, provides the income needed to make the payment and therefore they go hand-in-hand???

College/Universities, well there would be a bunch of other topics that could be put in their, but God has used even doctors to do His work, which requires quite an expensive degree. Certainly if one were to borrow money for school, logically the least amount as necessary, even with holding a job to lower that amount, would seem wise.

There are not answers for every question that could come up. One must read their Bible, study their Bible and hopefully have truly repented towards God and by faith believed into Jesus Christ as their Lord and Savior (Acts 20:21), thereby truly becoming followers of Christ or Christians. That is the wisest choice that anyone can make, following Him with one’s whole heart is what is commanded (Mark 12:30; John 14:15), thereby, with some basic knowledge about biblical principles, considering such dilemmas according to the Word of God and seeking wisdom from Him who Created us anyway (Jacob (James) 1:5) would be the way to make these decisions.

“If any of you lacks wisdom, let him ask of God, who gives to all liberally and without reproach, and it will be given to him. But let him ask in faith, doubting nothing, for he who doubts is like a wave of the sea driven and tossed by the wind.” Jacob (James) 1:5-6

Also consider:

“In all your ways acknowledge Him, and He shall direct your paths.” Proverbs 3:6

“O Jehovah, I know that the way of man is not in himself; it is not in man who walks to direct his own steps.” Jeremiah 10:23

Now let’s move on to discussing some of the issues with the world in which we live and what causes a lot of trouble for many people, even those who profess faith in Christ.

“For the love of money is a root of all evils, for which some being greedy, have strayed from the faith, and pierced themselves through with many sorrows.” 1st Timothy 6:10

There is an entire chapter that is dedicated to ‘being content’, so the predominant focus of the remaining portion of this chapter is going to remain speaking of out of what one has, though these two are somewhat redundant concepts, going back and forth.

So continuing with another biblical principle:

“The rich rules over the poor, and the borrower is servant to the lender.” Proverbs 22:7

I always thought the lay-a-way program that Kmart had back in the day was a great thing. There was no debt involved, simply you took what you want to purchase, took it to the back of the Kmart store, they put it on your account, added a small fee and when it was paid off THEN you would take home your merchandise. Plus if it went on sale during that time period when you were making payments, the sale would be applied.

On the other hand, if you didn’t pay on it, you would lose a small portion of your investment, but receive back most of you money, owing Kmart nothing for the merchandise you no longer desired to purchase.

Fast forward to late 2023 and I have seen numerous articles worrying about the rising trend for people to make payments on short term loans (usually 4 installments) for things that these financial gurus assume people largely do not need. I’ve seen the offers myself.

On purchases that I have made using Paypal, Amazon or even my Chase credit card, I have been asked to use these types of services to take that purchase amount (usually just over $100) and break it down into equal monthly payments, payments which are automatically made from a charge on a credit card or an ACH withdrawal from a bank account.

Could there be some use to these programs? Well Bob Jones University offers homeschooling to be paid using such a program, with no interest. For someone who is homeschooling and does not have the money, this might make sense.

Medical nowadays often requires prepayment on any deductible or copay due that health insurance is not going to cover, both regular health care and dental. If someone suddenly had need for a crown or a tooth extraction and the cost was exuberant, perhaps they might have to make the decision to use something like Care Credit to cover the cost and then figure out how to pay it off, whether by making cuts, making the regular payments (perhaps there was already a bit of excess money) or picking up some extra income temporarily. Once again, we must use the Bible for the basis of our decisions (1 Corinthians 10:31) and from time to time we will run into these sort of problems.

Now if we are being faithful to God, truly serving Him, which would include being good stewards with what He has given us, then we should rest securely in these sort of situations, knowing that God certainly will provide a way for these things to work out.

“And we know that all things work together for good to those who love God, to those who are the called according to His purpose.” Romans 8:28

Numerous times during my life I have seen the Lord intervene in situations where I did not know where the money would come from or how to pay for something that was –actually- needed, even when very expensive and the Lord has ALWAYS provided, according to His will (1 John 5:14). There is also a chapter about not worrying, so hold tight.

I will give one example of God’s grace.

In 2021 my wife needed a very major surgery. We utilize Christian Healthcare Ministries, which is like health insurance, but not health insurance. They reimburse after the expenses, but this particular hospital we eventually found out would require full payment PRIOR to do surgery.

We received a bill via email that required over $25k due in order to proceed. We actually have a credit card that has an amount over that for available credit. From having followed biblical principles, the account balance on that card was zero, so that entire amount could be placed on a credit card. This could remain as debt temporarily, were we would be reimbursed several months down the road, owing interest, but in the end the principle paid off.

Where God intervened was the hospital took a surgery and discounted it for self-pay by just over 80%! Never before, never after, has a hospital or any medical facility been so generous. They rated this major surgery at Medicaid prices THEN discounted on top of that! Had they only offered the 2023 standard (for out west) of 20% discount, we would have had to been in banks trying to apply for loans or seeing where else a loan could be had. We had contacted our health care ministry, to see if a possible prepayment could be made, but the hospital moved much faster than the ministry. In fact they moved so fast, that the hospital actually called to cancel the surgery, for nonpayment, not realizing that a payment had just been made the afternoon prior. If I recall correctly there was about 3 days from the time the email notice of a bill came until they called to cancel.

We were well aware that there would be something that would be due prior and assumed it would be at the max $10k, but were shocked to see it was the total amount estimated, but grateful for God’s intervention where we could still see to it to make that payment for this necessary surgery.

Time and space would prevent me from discussing how God provided business opportunities at just the right ‘needed’ time or how when I worked in restaurant management that God used these jobs, providing for our family and when one no longer worked out, another job was provided.

So God knows our needs, He also knows our desires and I have also heard from other Believers (and experienced) how sometimes God provides these things that we want, but do not necessarily need, to His children.

“For Jehovah God is a sun and shield; Jehovah will give grace and glory; no good thing will He withhold from those who walk in integrity.” Psalms 84:11

Still we are in a world, where so called ‘peer pressure’ or the normalcy of coworkers, friends, neighbors and even fellow churchgoers can push an individual or a family to spend money they do not have.

Then we could add the evil communication that corrupts good manners (1 Corinthians 15:33) wondering where the line is for covetousness (Exodus 20:17) how our modern entertainment depicts a lifestyle that is clearly anti-biblical or against biblical principles, notwithstanding the acceptance of the cultural to become the art that they are displayed constantly, thereby exasperating these sort of sinful desires, as well as causing a snare to much of mankind who can not afford these lifestyles that they have become accustomed to.

With the cost of goods nowadays, one of the reasons for writing this book, to be a help to those seeking answers from the Bible about dealing with the finances that no longer make sense.

If you were to read some of the old books, as I read one this past year by Larry Burkett, I quickly became angry, as this sound advice just didn’t work anymore. I purchased one, as the cost of goods both for personal and business has went up so much, our rent is the highest ever, our health care costs are very noticeable and then food continued to climb, not saying nothing about the shrinkflation that is noticed. Things got tougher, I needed hard numbers to be able to make the budget, without them, I began to overspend, which could excel out of control if not quickly extinguished.

Why read such a book? Well useful information, but I wanted to see if there was anything that I was doing wrong. No…I couldn’t find it. Prior I had prayed for God’s wisdom regarding finances, of which many of these biblical principles began to come to mind, I saw that there was now a real need to actual produce a family budget on a monthly basis to ensure that it was not a guess of how much someone could spend on food that month or how much in clothing or how much to go to a baseball game or whether or not a few things could be purchased, but rather a tight budget had to be made and followed. Where it would be modified, somewhere else it would have always have to have something taken away.

Perhaps in a budget an amount of $125.00 for electricity is put in, but the actual bill is only $87, great there is an extra $43 dollars that can go elsewhere! As a tidbit of advice, in my experience there is almost always some sort of unexpected bill or expense nearly every month. Nowadays you also have to watch out for price inflation shock. A small example:

I needed a USB flash drive, actually I thought 2. Well I put it in the budget for $15 at Walgreens. I had a couple of really expensive large ones that I had purchased and still have, but I needed just a couple of cheap ones.

When I went to Walgreens I got an ‘update’ or an awakening to the new prices compared to the old that I remembered from around 10 years ago. There they were on sale and the cheapest one that I found was nearly $24 (with tax) so I opted to simply purchase one and reutilize another that I had on hand, a junk one that someone else had given me awhile back.

In order to follow out of what one has, you NEED to know what you have. So while this book is not on financial advice (how to save for a house down payment, how to save for retirement, etc.) there is this concept of making a budget (unless you clearly make enough every month where you can follow such a thing and do not go over) that has to be realized for many who call themselves Christians. Oftentimes true Believers are actually on the poorer end (Luke 6:20-21; 16:19-31). In this country, the poor are actually fare quite well compared to citizens in underdeveloped countries.

There is not a one-size-fits-all method to doing a budget. I’ll briefly explain how mine is done, but our situations will likely not be similar.

Our income is derived from our business. Our customers are given a net 30. So, as this is written in December, the income arriving this month will have been earned in November…we are always one month behind.

Out of our income we must take a look at a couple of subtractions that tell us what the gross verses net income (the amount we have to actually spend is). For us, we actually put business expenses as a regular ‘bill’ but we take out taxes and tithing from the gross amount to see what is actually leftover to spend on everything else.

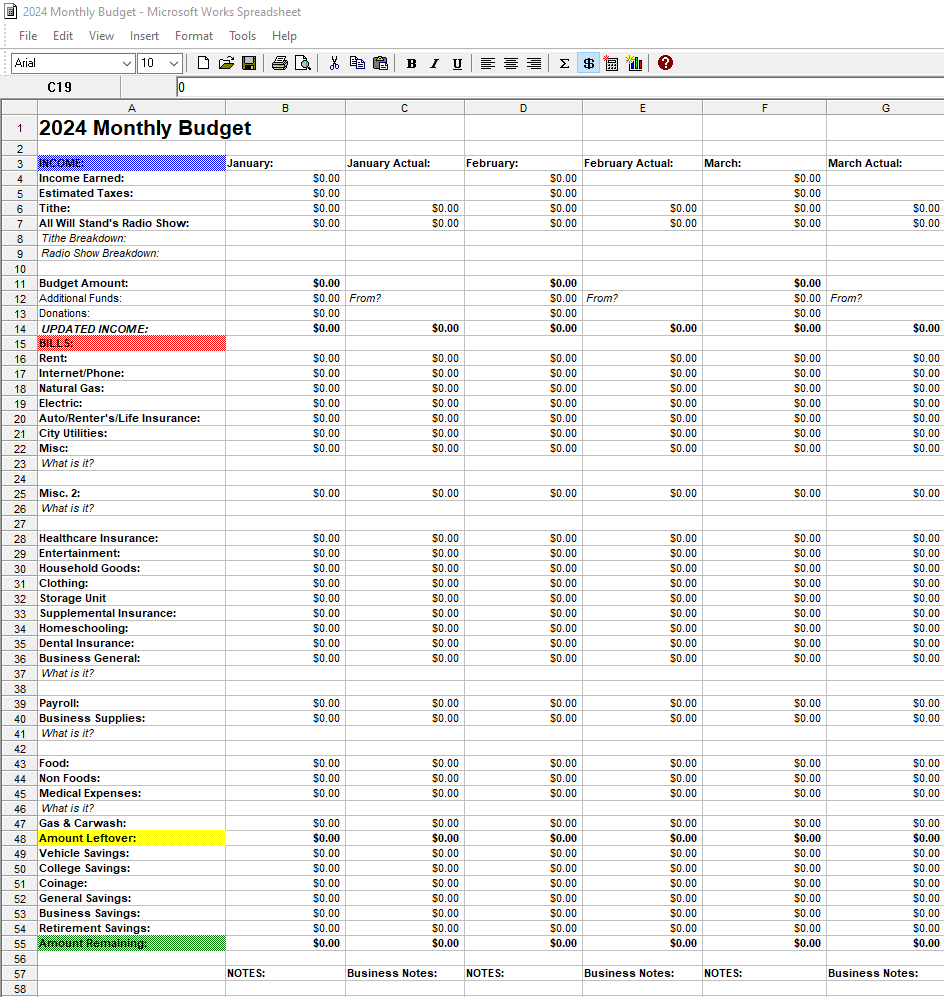

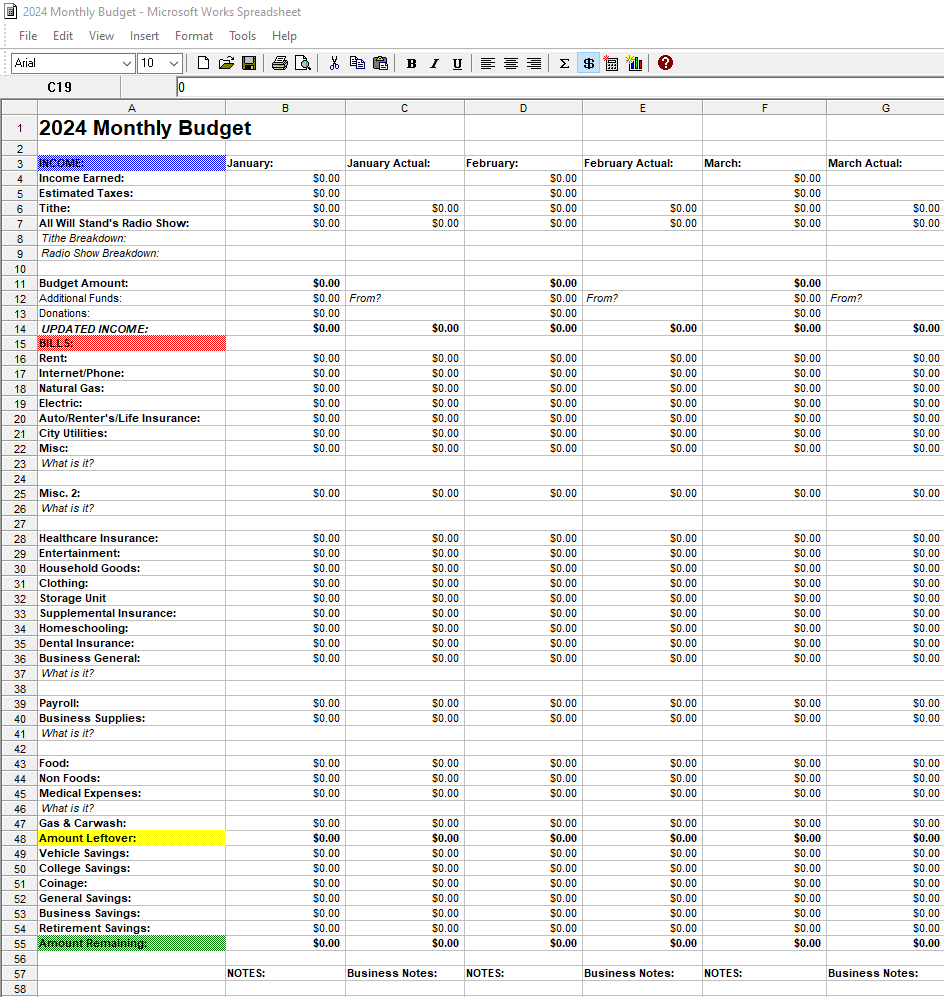

Even this changes from time to time, for recently there is a ‘donation’ section that helps to offset the expenses from the tithing, which includes paying for All Will Stand’s ministry needs, as well as personal tithing. So here is a snapshot of the upcoming 2024, designed SPECIFICALLY for our family needs:

So now let’s walk through this a bit. This might look well on paper, but the numbers would probably be a financial counselors eye for concern. I wouldn’t say a nightmare, but for example in November we saved .73 cents! Even though there is this whole savings section, that is ‘what we would like’ not necessarily what we are able to do. The only ‘non-spent’ savings that we had in November was a $105.00 out of all of those ‘savings’ categories and that going to two children for college, if the Lord doesn’t return prior to then.

Nonetheless, let me take and walkthrough this a bit, understanding that you might very well desire to design one, on paper or software (we actually use both) to meet your needs. Perhaps you have a real easy one, such as this:

Income Received from Work Checks $2,200

Portion of Rent (as a room mate) $700

Portion of Utilities (as a room mate) $145

Cell Phone $115

Food (eat for free at work, 5 days/week) $400

Entertainment $50

Tithing $175

Debt Repayment $68

Car Payment $265

Car Insurance $136

Gas $115

Leftover $31.00

Still, even with such an ‘easy’ one, you can see if you don’t watch your money tightly or something comes up (say you have to go to the doctor, without insurance!) then you could easily have a problem, one reason to utilize a basic budget, in order to do the best you can to spend out of what one has, not out of what one does not have.

Unfortunately that ‘sample’ budget would be your average worker at a lot of jobs. We could even pretend that the debt repayment is payment to a medical facility for an illness. Those numbers are not unrealistic, one more reason to possibly consider how short the time appears to be until the starting gun of the Rapture happens (1 Thessalonians 4:17)! That budget is based off of someone working one job, knowing that often they do not get a full 40 hours (especially in the winter), earning approximately $15/hour, knowing they get fed 5 days per week. Do not forget, I managed tons of workers in restaurants over the years. When you work in fast food, you see a lot of people come and go. (You can download a free copy of the book, The End, discussing the Rapture, Tribulation, etc., from allwillstand.org).

So quickly let me go line through line, providing a brief explanation for how our family budget works.

INCOME SECTION:

Income Earned – The amount we earned in business (gross) the month before.

Estimated Taxes – The amount our ‘tax estimator’ spreadsheet says we owe, after expenses.

Tithe – The amount given towards God’s work, to a Church or otherwise.

All Will Stand’s Radio Show – The monthly cost for the radio broadcasting.

Then some personal breakdowns of the budgeted amount.

Budget Amount – The amount leftover after taxes, tithing and broadcasting.

Additional Funds – Maybe someone sends me $25 for my birthday or I have to use a $100 from the business savings.

Donations – Anything anyone might send to pay for All Will Stand’s broadcasting or mission work.

Updated Income – The true amount left, adding in anything that might be added in for income.

BILLS SECTION:

Rent – The monthly payment due to the landlord.

Internet/Phone – Total cost of all internet/phone related bills. This is estimated each month, though fairly consistent.

Natural Gas – The amount of natural gas estimated to be used, off of past experience. A cold winter means more gas usage, during the summer, hardly anything for us.

Electric – The cost of electricity. During the winter months, much higher for us with some of our heating.

Auto/Renter’s/Life Insurance – Total cost of all insurances for the entire family under these categories, usually a fairly consistent bill.

City Utilities – The amount of water/sewer/garbage bill estimated to be used, usually also fairly consistent.

Misc. (1 & 2) – These are expenses that are upcoming. A note is made during the current month of upcoming expenses for the next month. For instance (written in December) for January already I have $100 due for homeschool band that might well fit under that category. Last month it was an oil change and tire rotation. These are estimated, where the total isn’t known and usually for a bit higher, as it more often seems to cost more than less.

Healthcare Insurance – Our monthly premiums for our family health care solution.

Entertainment – The amount set aside for entertainment. Perhaps going to a restaurant, bowling, ice skating or something else, those sort of expenses.

Household Goods – The amount budgeted to purchase a new household good. Maybe a new book or a new lamp or something desired for the kitchen.

Clothing – The amount put away for clothing each month. You might be surprised to see how much this can actually add up for a family with kids. Shoes alone can be quite an expense.

Storage Unit – The monthly cost for the storage unit.

Supplemental Insurance – The monthly cost for supplemental insurance needed by a family member.

Homeschooling – This is a BROKE DOWN budget. Two kids homeschooling using Bob Jones University distance learning DVD’s + needed learning materials (school supplies, DVD players, headphones, backpacks, science kits, books, etc.) seems to come out for our family to roughly $3,000 per year.

So these are one of those expenses that many would have to breakdown. When school is purchased, it can easily cost $1,300 per student for just the material. So the $3,000 breakdown is $250 per month.

So every month, unless that month there might be something extra, $250 is put into a special savings account at the bank. When school is needed, that money (minus the $250 that would have been saved that month anyway) is paid using those funds. A $1,300 cost in one month is something that can throw off anyone’s budget. These sort of known expenses should be broken down and made ‘doable’ through equal payments.

—Edit— 1/30/24

So interesting, due to the rising costs of homeschooling material, as well as a science project kit, etc., the budget has had to be raised $50 per month beginning this year! This is how things change. We could either lower our standard (not get the science kit) or we must increase the budget, perhaps cutting elsewhere???

Dental Insurance – Monthly family premiums, an annual fixed expense.

Business General – One that most people will not have. This category covers things such as liability insurance, state annual reports, postage, non-tangible expenses.

Payroll – An expense that we added to help out son earn a little bit of money for college, as well as help us out during projects.

Business Supplies – This category is all of the tangible items, equipment, office supplies, etc., that are needed on a monthly basis. This is a cost that can be found out prior to setting the budget.

Food – One day per week is picked to go shopping, even if it turns out to be multiple days in one week, for budget purposes. For instance ‘Mondays’. Some months there are 4 Mondays, some there are 5, so this helps keep your budget in good order, even if you go shopping on Tuesday that month. How many ‘weeks’ in a month depend on how many of that day that all of the expenses are added up for the ‘week’. So if your budget is $200/week and your shopping day is Wednesday and there are 5 Wednesday in that month, then your budget would be $1,000 for that month.

Non Foods – This is everything else that is needed and consumed. For instance, soap, shampoo, toilet paper, laundry soap, cleaners, etc. An important way for us to make our budget is to try and set a fairly stable amount, say $150.00 per month for a family of 4. If you are near the end of the month and have only spent $101, it might be prudent to say purchase another container of laundry soap, a gallon of bleach and some extra sandwich bags, bringing the total to $142 for the month, rather than the following month realizing that you are low on these things, plus your regular expenses and spending $185, when you only had $150 budgeted.

Medical Expenses – This would be any and all of the estimated out-of-pocket expenses for any medical care, including vision and dental, plus prescriptions. In my experience it is always better to overestimate the cost than underestimate the cost, for medical is usually more expensive than one would hope.

Gas & Carwash – Usually for us, vehicle maintenance goes under one of the miscellaneous categories. Here is the estimated amount of gas needed plus the expense of car washes throughout the month.

AMOUNT LEFTOVER:

So now there is an amount leftover. Our particular budget has two sections. One is the budget that is done prior to the start of the month in the left column. The right column for the month is what is actually spent and added up during the month. Tweaks of the amount are done as available.

For instance if the estimated electrical bill was less than that extra money might be placed into a different category, where it would seem prudent.

A word of caution, if one were to model their budget off of the one that we currently use, all of which is a working spreadsheet with some built in formulas. The ‘savings’ section at the end is best to wait until the end of the month if you have a tight budget. It is very disappointing if you place $200 away into vehicle savings only to find that you actually need the money for say medical. It is better to wait to near the end of the month when the likelihood of needing the money has greatly diminished.

Originally we had less saving categories and perhaps we go back to that. In the past year, with the exception of some business savings, nearly any savings has simply been that same $105/month for the kids college. This is the world we live in.

Sometimes looking at these sort of things, though often necessary, might drive someone to think they are doing something wrong. Well in our case we earn a living, as we always have, but our healthcare expenses are high, our rent is high (in comparison to what we have always paid). While it might only be the $1,400 a month, when all utilities and the storage unit is added up, it is close to $2,000 a month or $24k a year. If we add in our health insurance costs we are now at $40k per year. So after doing this type of a breakdown budget for a year, I eventually found an old book by an author (mentioned prior) just to see if I was out of my mind and doing something wrong.

Well, let me take a brief liberty to say that the home prices in many areas of the country climbed astronomical amounts in the past several years, as well as healthcare costs, food, vehicle costs, you name it. Our income, while up some from years ago, still has us with considerable less after all of the additional expenses and this with following the biblical principle of out of what one has, so back to that now.

Most people should have a budget and perhaps you are fortunate enough to be able to save for retirement, save for upcoming events, take vacations, as well as spend reasonably on the things that you want and need, as the Lord provides. Nonetheless, for many this seems to be more of a treading water situation while the world’s elite waits for the starting gun of the Rapture, where the Antichrist is unveiled, as they continue to set their trap. So now remember that the borrower is servant to the lender (Proverbs 22:7), well have you ever heard of the ‘great reset’ being spoke about?

In a nutshell, having put my own thought into articles that had been read a few years ago regarding this ‘great reset’. Essentially the nations and many households will end up with too much debt (intentionally), then there will be some sort of major crisis (war, new pandemic, something) that will cause the financial systems around the world to collapse.

Those in power will offer a solution, this solution will also switch the United States dollar from the reserve currency of the world to an already preplanned (from at least the 1970’s) SDR unit or some other concoction of a ‘basket of currencies’ to replace the USA as the sole reserve currency, paper or digital.

There will be a large amount of forgiveness or a very well suited restructuring of debt that will allow society to move forward. As mentioned briefly in the book The End, this, if in God’s timing, could easily give way, if God allows, to the timing of the Rapture and the rise of the Antichrist. This is dangerous stuff.

Either way, it certainly would set the stage completely for a one world currency, even though individuals might hold their nations’ respective currency, they would behind the scenes be lumped into a basket, so in essence a one world currency. Time will tell, but certainly there are quotes found from those who are in positions to try and make such things happen, all across the world.

Imagine a society, like we have now, with out of control government debt, with many other countries that have the exact same problem and others that are simply so poor, if economic conditions greatly deteriorated then they would be in the same boat as well. Well we have war in the world (as of this writing) with Russia verses Ukraine. (1/30/24 Update: Now also Israel verses Hamas.) If that were to get out of control and nuclear weapons began to be used and somewhere a million or so people died, now you have the crisis, now you could see the bottom falling out, now you could see how countries would be willing to give up a bit of their sovereignty to ‘resume normalcy’ after such an incident. Certainly a theory, but not that far off of what could readily happen.

In such an instant, due to the implosion of the economy, the debt (or poverty of a nation) would require (reasonably) to work with the United Nations to fix this problem. Well, the borrower is servant to the lender and those who hold debt, especially those that are more than what should have been taken out (expensive house loan) or simply a bunch of vehicle payments, credit card debt, etc., are also going to be looking at their respective government as to what it’s solution might be.

So debt can easily trap and limit a persons options. Once again…

“The rich rules over the poor, and the borrower is servant to the lender.” Proverbs 22:7

The problems that can arise when an individual or family does not follow the biblical principle of ‘out of what one has’ are endless. While certainly there would be times where one would prayerfully consider a situation, where a temporary aid would have to be had, debt acquired, but someone whose heart is right before their Creator would assume that out of His abundant mercy, this would be able to be repaid in short order or without too much trouble.

Still there are many who get themselves into situations where they end up spending more than they make, which then becomes a financial blunder instance, that then becomes an more financial instances, over time, sometimes quickly, they find themselves in serious financial troubles, not due to something that comes up unexpected that might require a short term loan, as with this example:

Your family is managing the finances well, however, there is not much leftover each month. You work, tithe, pay the bills and then suddenly your vehicle needs a new transmission that costs around $4,000.

Having only $500 on hand, you take out a loan for the rest. If you didn’t you wouldn’t be able to make it to work to continue earning money.

Now let me be clear here, this author is not in the least bit trying to suggest situational ethics with God’s written Word. I have found myself in such situations over the years, when in all instances, I do believe if I had been more diligent with saving some of the surplus that my family had, we would NOT have needed a loan. God had given the money, perhaps we didn’t have to fill our house so much with trinkets, so another situation where perhaps the ‘good steward’ principle had not been followed caused this situation. This is exactly the problem with not following biblical principles, though one’s heart should always be right before their Creator, their walk with Christ should be genuine.

In most cases what I have seen, a lot from managing tons of different people over the years in the restaurant management industry, if that the far vast majority of people get themselves in trouble from simply spending more than they make per month.

A more likely scenario is not putting aside a bit of the excess that God has provided to the individual or family. Please Note: This author is not providing advice on savings/investing/etc. There are other authors who have spoken about such things and perhaps if a recommendation can be made Larry Burkett’s books on such subjects, with a Christian perspective might be found useful.

So what happens when someone spends the excess and then has to ‘float’ an unexpected expense on a credit card to the following month? Well if the next month there is more of the same, then before long someone might have to transfer this credit card debt that is accumulating to either a small personal loan or a lower interest credit card.

So now, let’s say that the repayment on this whole ordeal of financial blunders in the course of six months turns out to be $225/month for 10 months. Well now that is ten months in which that comes out of what one was already earning, meaning that things are now more restricted then they were before.

So in essence, what is happening is the borrower must now perhaps suffer for a bit to correct this problem. Maybe instead of eating out for lunch a day or two per week, it is only a day or two per month? Perhaps the amount of electricity being used is monitored, maybe a few generic items are purchased they had not been? What can often happen is that this scenario gets a bit worse over time, to the point where then floating the income with credit cards becomes a financial burden.

Sometimes they can simply correct themselves, income tax refund, unexpected money, promotion at a job or simply selling something that is no longer needed. Oftentimes what happens is the individual or family will end up having to work more to pay off the additional expenses, which then by being busy usually has the monthly expenses go up (eating out more, etc.), which means the process is slower than one initially expects.

Nonetheless I have seen many people go into utter financial ruin, some slowly, some quickly, some stayed in that situation for years, some never fully recouped. These financial choices, when we have them, when they are within out control, should be made following the principles that God has laid out in His Word, readily available to each individual.

We need to be diligent to avoid these problems, knowing that if a situation comes up that is out of our control, that we can simply lay it before God in prayer, knowing that He cares for us and will be our help.

“Therefore humble yourselves under the mighty hand of God, that He may exalt you in due time, casting all your anxiety upon Him, because He cares about you.” 1st Peter 5:6-7

“God is our refuge and strength, a very present help in trouble.” Psalms 16:1

Amen!